Conventional CFOs will tell you that now is the time to develop an elaborate dashboard with KPIs and metrics that track every aspect of your business.

A dashboard is a powerful tool, but they are full of individual metrics that don’t show you the overall snapshot picture of your business. This makes it difficult to make objective decisions quickly and efficiently. Additionally, it won’t tell you the amount of cash position today and in two weeks. Ditch the 2025 elaborate dashboard.

Enter the unspoken financial hero: the operational budget with a cash flow forecast.

You can optimize your business’s financial performance by making quick adjustments and informed business decisions by implementing our free Operational Budget resource. Simply make a copy of the resource, fill in the Estimates column with your current year forecasts, update with your Actuals, and then identify and review your Variances.

The operational budgetis a live report that adjusts as you close out the month so you can make objective decisions timely. It provides visibility into:

- The budget for expenses

- The forecast for revenue

- and your cash position over the time period you are reporting and into the future.

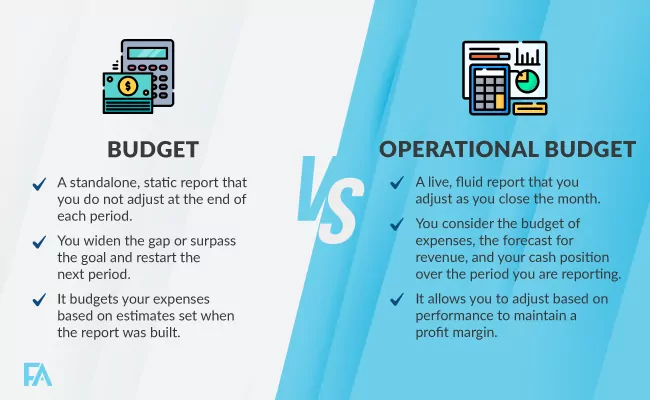

What’s the difference between a budget and an operational budget?

Is the budget process dead? How should it be used in conjunction with reporting?

It is not dead, but how we use the budget has evolved, and we no longer should be using a static budget or just estimates as part of our regular reporting.

With online shopping and on-demand purchases and refunds, business moves so much faster in today’s world. Businesses need to be able to react quicker than ever. Fluid reporting allows businesses to pivot and not wait until the close of the time period to review the report and make decisions.

What do digital business owners often overlook when it comes to forecasting?

They often overlook churn, refunds, or underperformance. We often see forecasts being so aspirational that the day-to-day operator can’t effectively use the report.

When should my business start building out an operational budget for 2025?

Your business should start in mid-November (now!) or the beginning of December and readjust once you close December in early January.

The more dialed in you have your forecasted revenue and estimated expenses, the more clear you can be in executing your marketing strategy and staffing model to support your business.

Whether you’re a startup or an established business, this tool (make a copy here) empowers you to make better financial decisions to have a prosperous New Year!

Rachel Phillips

CEO of Fully Accountable