The tax deadline is upon us. Many business owners face the same questions: How did that tax payment sneak up on me again? And how am I going to manage cash flow to make the payment AND keep my business afloat?

Here’s the good news: You don’t have to scramble anymore. With the right planning, this can be the last year you’re caught off guard when it comes to tax payments.

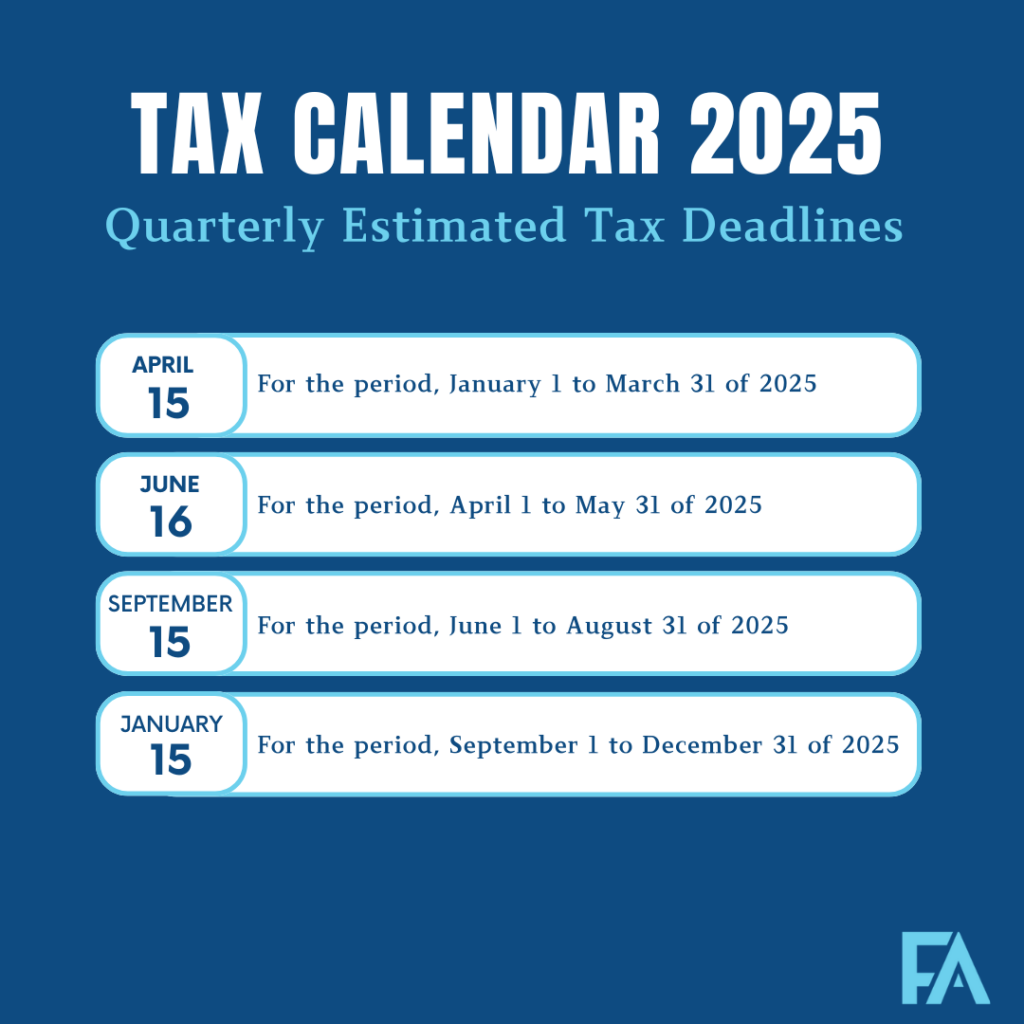

Quarterly tax payments are your key to managing taxes more effectively and avoiding surprises.

These are payments made to the IRS throughout the year, at the end of each quarter, and calculated based on last year’s income. Paying these on time does more than just keep you compliant — it helps you plan ahead and strategize for cash flow in your business.

Here’s why you should embrace quarterly tax payments:

- Avoid the Year-End Crunch: This allows you to implement a year-round tax strategy so you’re not left scrambling at the deadline.

- Stay in Compliance: Paying quarterly meets the IRS’s safe harbor requirements so you do not accrue any interest and avoid penalties; and

- Plan for Cash Flow: By making these payments, it helps you plan and strategize cash throughout the year.

Quarterly tax payments only take into consideration the amounts needed to meet the safe harbor based on the previous year’s income. That means it’s a good practice to run tax projections in June and October. This helps you assess if you will owe more taxes than what you have paid in and allows you to make additional payments with your quarterly estimates.

Let’s face it — no one loves paying the IRS early.

But no one likes paying the IRS more than they need to because of penalties and interest. By staying on top of quarterly payments, you’re ensuring your business stays cash-flow positive, compliant, and free from the sting of surprises.

Let’s make this the year you lose the scramble at the deadline and take control of your tax strategy with estimated quarterly payments.

Rachel Phillips

CEO of Fully Accountable