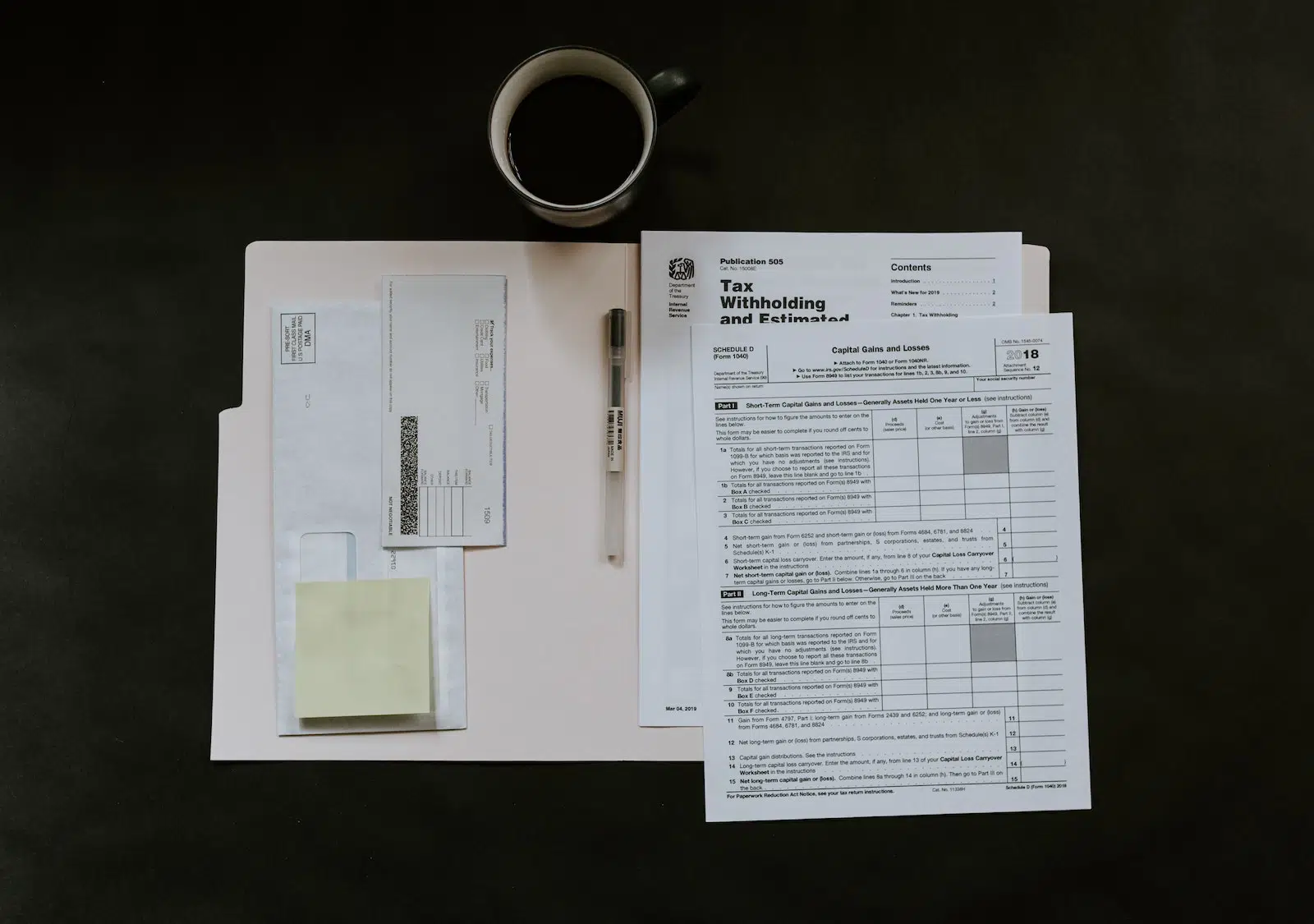

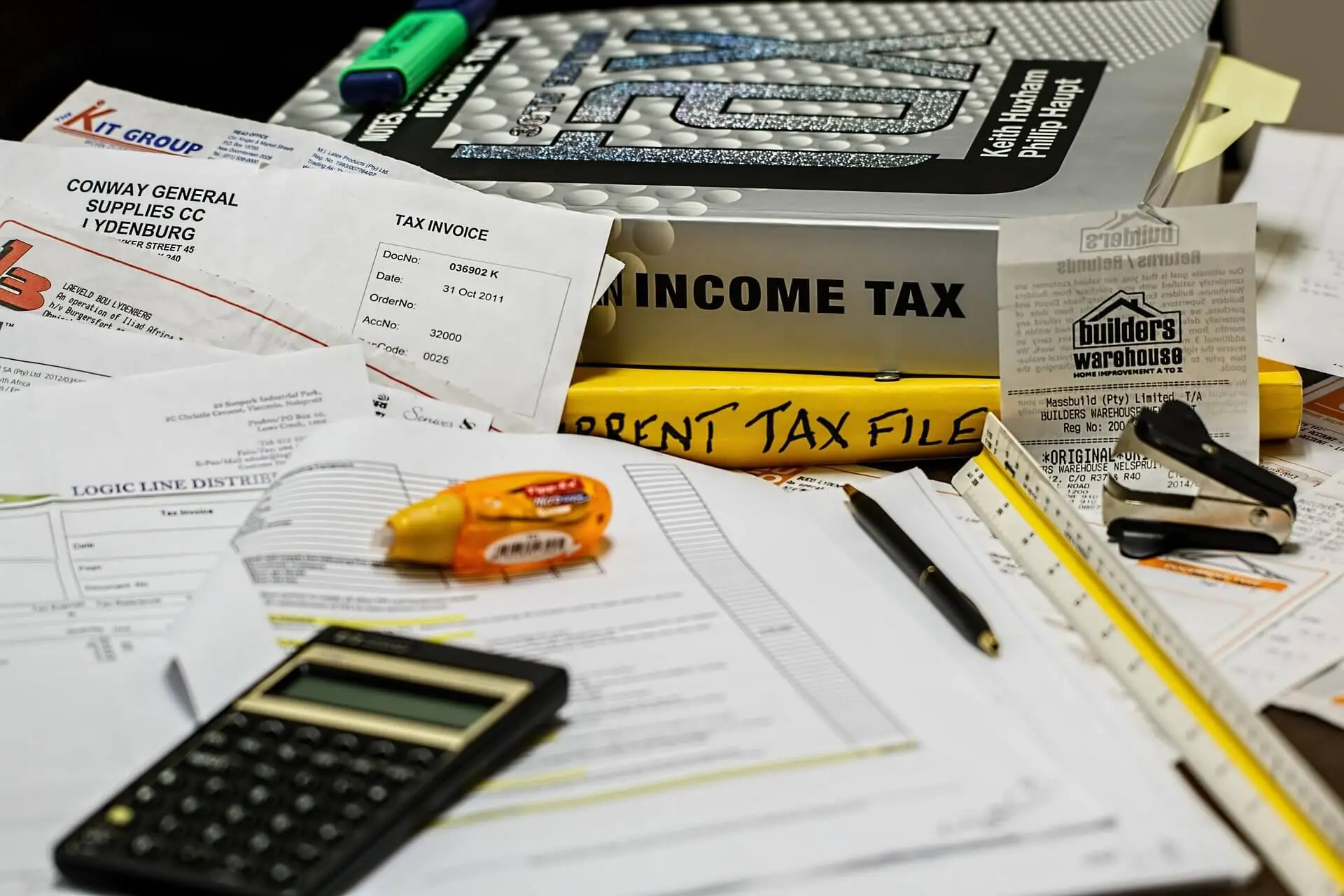

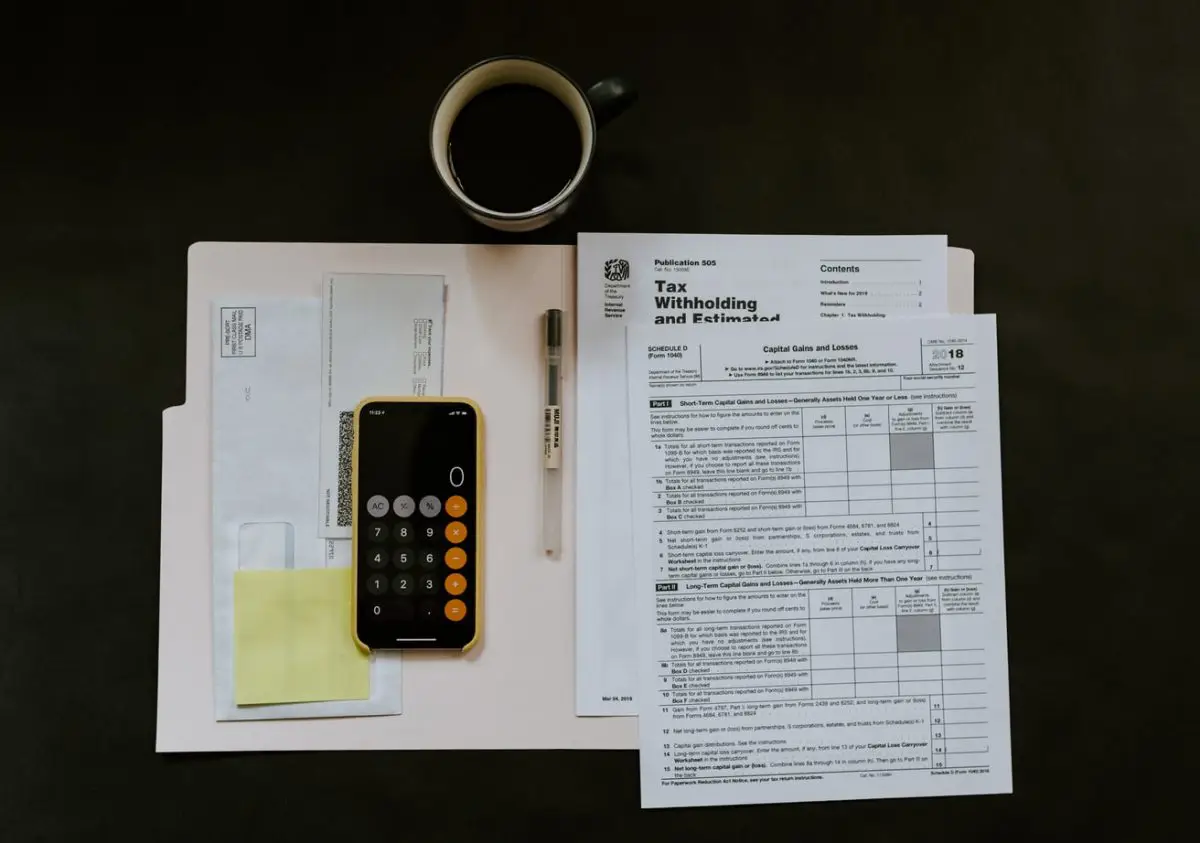

Spring has sprung, and we are all excited about the warmer weather and longer days. But for all its sunshine, spring also means tax season. Tax compliance services and tax planning are essential for long-term success regardless of your industry or company size. And if...