What Could Your Business Achieve With a Tax Savings Strategy?

As the end of the year approaches, now is the ideal time to focus on how to put more money away tax-free and implement strategies that reduce your taxable income.

Fully Accountable clients who adopt a tax savings strategy typically see an average of $100,000 in savings. Don’t wait until the tax filing deadline — proactively manage your finances for both compliance and maximum savings with our tailored approach.

To help you navigate the complexities and maximize your savings, we’re excited to offer a Tax Planning Strategy Session with our experts that is tailored to your company.

Get a Free 30-Minute Strategy Call

Leverage the experience of an accounting professional to gain certainty around your financial outlook. Gain personalized insights around cash flow, opportunities, and strategies to improve your margins and further scale your business.

Maureen has a proven history of forecasting, account management, proposals, contracts, & trend analysis.

Maureen studied at Appalachian State University with a Bachelor’s Degree in Marketing and Management. She lives in Virginia with her husband and her dog, Woody.

Get your FREE 30 min strategy call!

Our Awards

Why Book a Consultation with a Tax Strategist?

- Maximize Savings

We’ll analyze your current tax situation and recommend strategies on how to lower your taxable income. Whether through entity structuring, expense management, or strategic deductions, we’ll advise so your business operates efficiently from a tax perspective. - Be Proactive

Our tax planning session will help ensure your business is compliant and uncover saving opportunities, particularly as tax laws evolve. Our team will show you the latest tax savings tips and strategies that benefit your business.

How is Tax Strategy Different than Tax Filing Services?

For Your Investment, You’ll Receive:

- A 60-minute consultation with one of

Fully Accountable expert tax strategists. - A customized tax-saving strategy guide with actionable

steps tailored to your business, ready for you to implement.

Schedule your session HERE. Spots are limited, so don’t wait!

We’re committed to helping you achieve your financial goals. This strategy session is a valuable opportunity to ensure you’re making the most of your tax planning efforts

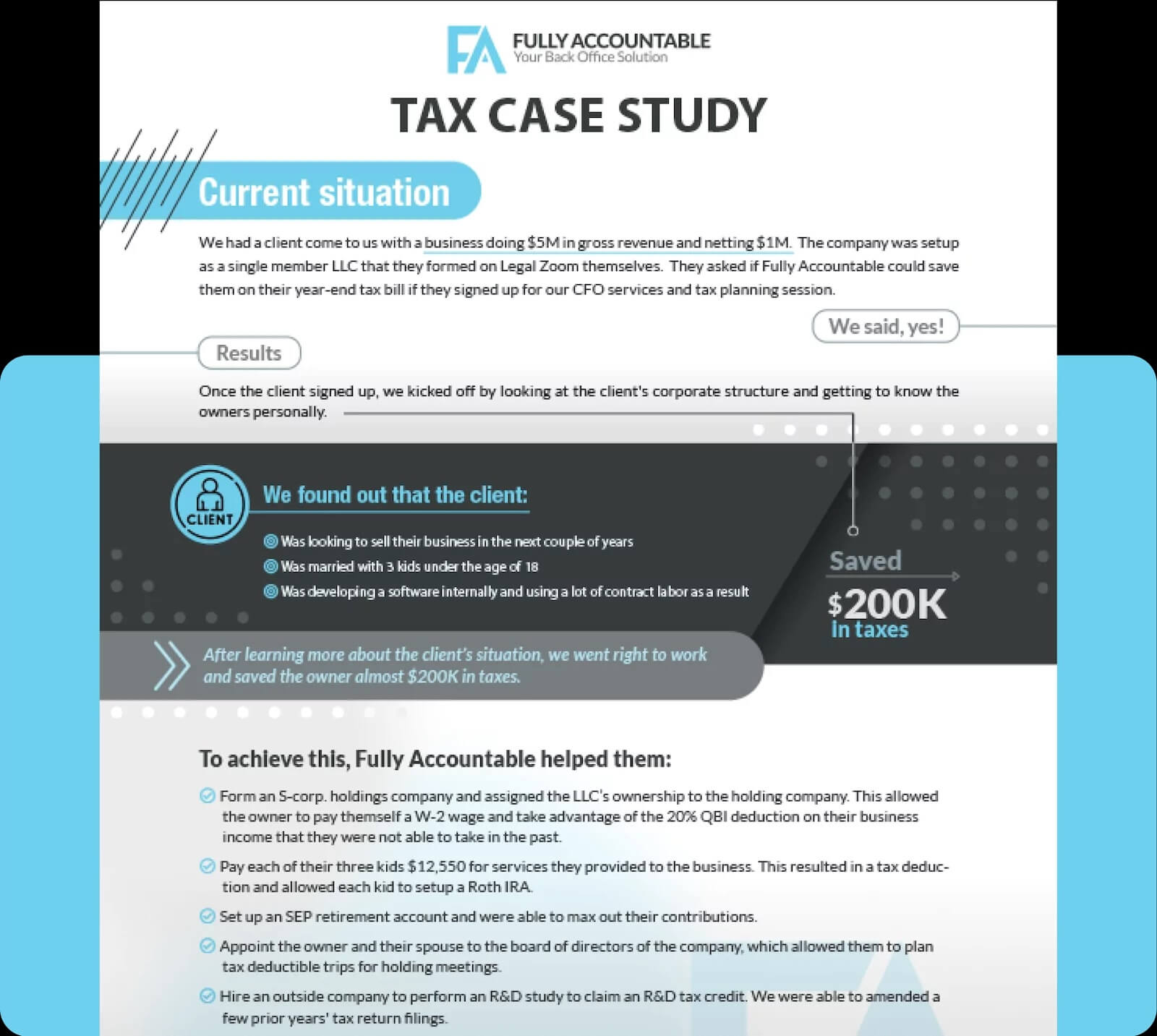

Tax Strategy Case Study

Once the client signed up, we kicked off by looking at the client’s corporate structure and getting to know the owners personally.