Whether your digital business is growing or your company has recently transitioned to online products and services, this guide will help you understand the basic methods, components, and complexities of e-commerce accounting.

Conventional thinking says accounting is accounting. But that’s not true for e-commerce accounting, which is different because it’s accounting for online businesses. Fully Accountable’s CEO Rachel Phillips and CFO and President Chris Giorgio have spent the last decade as digital accountants working with thousands of e-commerce and digital companies to double their profit margins. They’re here to share their insights and industry knowledge on common accounting challenges for e-commerce companies.

If you’re like most busy business operators, numbers and accounting can be scary. We get it, which is why you’ll walk away with a baseline knowledge of e-commerce accounting, so you can be familiar with the components that will affect your financial health and cash flow.

Article Contents

1) E-commerce accounting defined

2) Ask an Expert: e-commerce accounting FAQs

3) Components of e-commerce accounting

4) Types of accounting methods

5) General differences: Cash vs. accrual accounting

6) Simplify financial management with Fully Accountable

What Is E-Commerce Accounting?

E-commerce accounting is the practice of managing, organizing, and recording all financial data and transactions for the operation of an e-commerce company.

Whether your digital business is growing or your company has recently transitioned to online products and services, this guide will help you understand the basic methods, components, and complexities of e-commerce accounting.

Conventional thinking says accounting is accounting. But that’s not true for e-commerce accounting, which is different because it’s accounting for online businesses. Fully Accountable’s CEO Rachel Phillips and CFO and President Chris Giorgio have spent the last decade as digital accountants working with thousands of e-commerce and digital companies to double their profit margins. They’re here to share their insights and industry knowledge on common accounting challenges for e-commerce companies.

If you’re like most busy business operators, numbers and accounting can be scary. We get it, which is why you’ll walk away with a baseline knowledge of e-commerce accounting, so you can be familiar with the components that will affect your financial health and cash flow.

Just like traditional accounting, the objective of e-commerce accounting is to provide a clear financial picture of the business, ensure compliance with relevant regulations, and aid in strategic decision-making.

Ask an Expert: E-Commerce Accounting FAQs

What are common accounting issues for e-commerce businesses?

Some of the typical issues we see with e-commerce businesses include attributing advertising spend to sales revenues and making sure all product costs are associated with the revenue.

How is e-commerce accounting different from traditional accounting?

Every digital business is unique. E-commerce accounting is different in that it allows for customization of reporting by sales channels and by products.

Likewise, the process of reconciling is slightly more complex. In e-commerce accounting, sales and ensuring proper “gross up” of sales for sales discounts, refunds, chargebacks, and seller platform fees can be challenging as all platforms have different reporting.

Is cash or accrual accounting better for my business?

For the majority of our e-commerce companies, accrual accounting is best as it properly attributes costs to the revenue derived from them. Cash-basis accounting is mainly used by smaller companies that manage their company by their bank account balance and do not understand the benefits of properly attributing costs to the revenues produced by those costs.

Accrual accounting, unlike cash-based accounting, allows you to manage your cash effectively through the use of cash flow statements. These statements, often overlooked by business owners who have been trained to focus only on profit and loss, are crucial in understanding and managing your business’s cash flow.

Is cash or accrual accounting more common?

Cash is common for smaller companies that run their company from their bank account and prepare financials mainly for tax reporting purposes only. Accrual-basis accounting is best, as it produces the most transparent data that better allows for projection and data for more proactive planning. This is normally done by larger businesses that have the resources to use this data.

What Are the Components of E-Commerce Accounting?

If you’re new to business finance, accounting terminology can sometimes be overwhelming and confusing. To provide clarity, here’s the breakdown of the key components of e-commerce accounting:

- Sales Accounting: All the income generated from the sale of products or services online. This includes not only product sales but also digital goods, subscriptions, and any other source of income.

- Cost of Goods Sold (COGS): It’s crucial for e-commerce businesses to accurately track the total costs associated with producing or purchasing the goods they sell online. This includes costs like raw materials, direct labor, and manufacturing overhead. It does not include overhead expenses like marketing, payroll, software licenses, or office space.

- Inventory Management: Unlike brick-and-mortar stores, e-commerce businesses might store inventory in multiple locations, including warehouses, fulfillment centers, or drop shipping suppliers. It’s critical to track inventory levels, turnover rates, and valuation (using FIFO, LIFO, or another method).

- Expenses: Like any business, e-commerce entities incur expenses. These can range from platform fees (like those charged by Amazon or eBay) to payment gateway fees (from entities like PayPal or Stripe), marketing costs, shipping fees, returns, and other operational expenses.

- Sales Tax Collection and Remittance: Online sales might be subject to various sales taxes, depending on the jurisdictions of the seller and the state in which the buyer resides. Proper accounting ensures the right amount of tax is collected and remitted to the correct authority.

- International Transactions: For e-commerce businesses that sell internationally, accounting needs to address currency conversion, international tax obligations, tariffs, and import/export regulations.

- Financial Reporting: E-commerce businesses still need to produce financial reports, like income statements, balance sheets, and cash flow statements, tailored to their unique operations.

- Reconciliation: With the multitude of payment gateways and methods available (credit cards, digital wallets, bank transfers, etc.), reconciling deposits to actual sales can be more complex for e-commerce businesses.

- Fraud Prevention and Detection: Due to e-commerce’s virtual nature, there’s an increased risk of fraud, but e-commerce accounting systems often incorporate fraud detection and preventive measures.

- Integrations: Many e-commerce platforms (like Shopify, WooCommerce, and BigCommerce) integrate with accounting software (like QuickBooks and Xero) to streamline the accounting process. This helps in automating many tasks like sales data import, tax calculations, and more.

Next, let’s define the two types of accounting methods.

What Are the Types of Accounting Methods?

Two options are available: cash-based accounting and accrual accounting. An e-commerce company must choose between either method.

Neither is the objectively best method of accounting, as they both have their benefits and limitations. However, once you pick one, changing to a different method of accounting is a bit more complicated, as it requires filing paperwork with the IRS.

If you’re unsure which is best for your e-commerce business, understanding them can help you make the right decision.

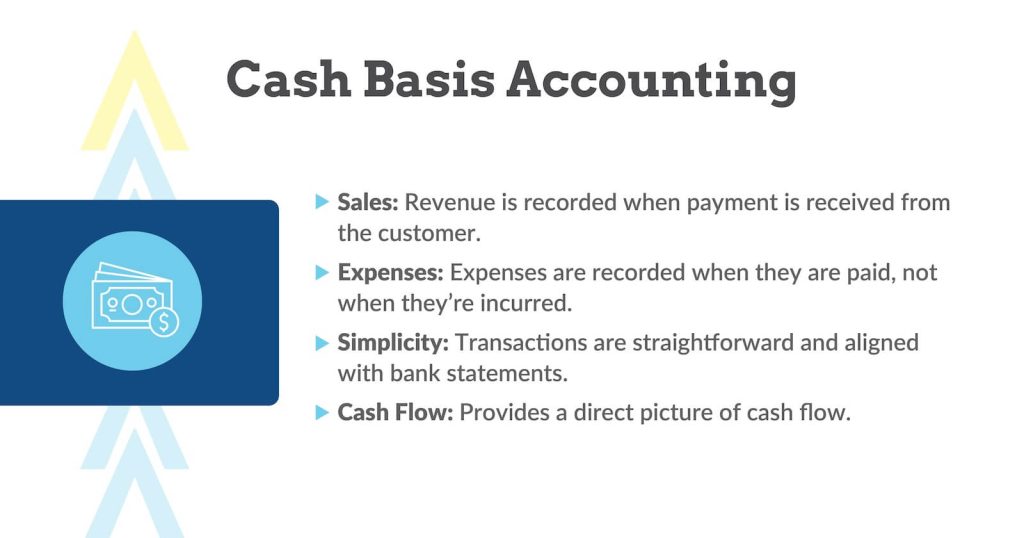

Cash-Based Accounting

In cash-based accounting, revenue and expenses are recorded when cash is actually received or paid, regardless of when the goods or services were delivered or received. If a customer buys a product today but pays a week later, the sale is recorded a week later.

The cash method is easy to use and understand, particularly if you have no prior experience handling a business’s finances.

Personal finances and, in their early stages, many small businesses run on a cash basis with a real money-in and real money-out approach.

Example:

Let’s say you run an online apparel store and receive an order for a $125 sweater. After shipping the product to the customer, you would record the income from the sale only when the customer’s payment is received and deposited into your account.

The same fundamental applies to expenses. Let’s say you have an outstanding invoice for $800 from a graphic designer for t-shirt designs. If the payment is still pending by the end of the quarter, you will be liable to pay taxes on that amount, even though it hasn’t been settled. In cash-based accounting, the expense is recognized when the money is disbursed from your account.

The upside of cash accounting is that it provides e-commerce owners with a clear and accurate picture of their operation’s cash flow.

The downside to cash-based accounting is that it provides a snapshot of your business transactions at a particular point in time, but it doesn’t consider liabilities and receivables. It’s also not suitable for all businesses. If your gross receipts cross the $25 million threshold, you’re required to use accrual accounting.

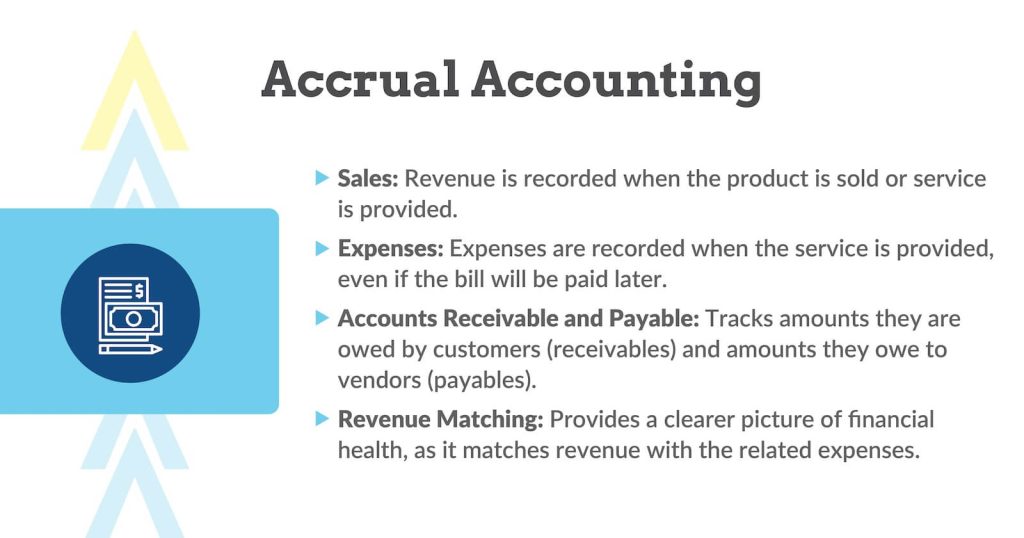

Accrual Accounting

With accrual accounting, revenue and expenses are recorded as soon as they are earned or incurred, regardless of when the cash or money is actually received or paid. If a customer buys on credit or through a delayed payment mechanism, the revenue is still recorded at the point of sale.

Accrual accounting reflects a more comprehensive view of your online business’ health because it includes receivables and liabilities, matches revenues with expenses, and helps monitor your organization’s profitability.

Example:

For instance, if an e-commerce business sells a product in January (and records the revenue) but doesn’t pay the supplier until February, both the revenue and cost are accounted for in January.

The advantage of accrual accounting is that it offers long-term insight into the health of your operations and the health of your business because it tracks all income and expenses. The downside is that the method is more complex, and tracking cash flow can be difficult.

For example, your income statement may show thousands of dollars in revenue from sales; however, depending on when the customer clears an invoice, you might not receive the cash for several months.

General Differences

Accrual accounting is typically more complex than cash-based accounting due to the need to track payables and receivables. Some jurisdictions or financial institutions require businesses (including e-commerce) to use accrual accounting, especially as they grow in size.

While cash-based accounting reflects cash flow, accrual accounting provides a more thorough view of a company’s financial health, as it accounts for future cash inflows and outflows.

Ultimately, the choice between cash-based and accrual accounting will depend on the nature and scale of the e-commerce business, regulatory requirements, and the owner’s preference.

Simplify Financial Management With Fully Accountable

No matter the accounting method you choose for your digital business, we can help.

We speak digital! Fully Accountable is an outsourced e-commerce accounting firm specializing in the nuances and complexities of online businesses, such as multi-channel sales, international transactions, and sales tax in different jurisdictions.

You focus on your business, while we focus on your daily accounting, record keeping, tax preparation, and financial reports. You’ll receive better data so you can make better business decisions.

As your e-commerce business grows, so will your accounting needs. We easily scale our services to match your growth trajectory, ensuring you always have the right level of support and software.

Beyond transactional accounting services, Fully Accountable is your business partner offering financial insights, budgeting, tax compliance, forecasting, and advice on financial strategy, helping e-commerce businesses make informed decisions.

Fully Accountable is Your E-commerce Accounting Partner

Fully Accountable is a top-rated outsourced accounting and Inc. 5000 honoree, a list that tracks the top 5,000 privately held companies in the country.

We offer outsourced e-commerce accounting services, as well as outsourced CFOs and controllers, who can provide you with high-level financial reporting and business strategies. If you’re ready to rein in your finances through accurate accounting that will relieve that pressure, contact us or book a Discovery call at (877) 330-9401.