SaaS Fractional CFO Services for Optimal Financial Growth

Streamline Finances, Cut Costs, and Maximize Profitability

When you partner with Fully Accountable, you gain access to a suite of specialized financial services for SaaS companies. We provide the expertise and tools necessary to boost profitability and streamline operations. From financial planning to comprehensive financial analysis, we ensure each financial decision is properly vetted and backed by easy-to-understand data.

Let Fully Accountable take your SaaS company to the next level.

What Is Outsourced

CFO for SaaS?

Why Hire an Outsourced

CFO Firm for SaaS?

Strategic Financial Expertise

The revenue models that SaaS businesses deal with require an astute financial mind to navigate the nuances.

Growth Management

Too much growth too quickly can be a bad thing if it’s not managed properly. That’s where an outsourced CFO for SaaS companies can step in, helping companies grow at a steady, stable pace.

Scalability

Scaling is essential to the growth of any business. An outsourced CFO can help you scale your business gradually so that your overhead doesn’t become a liability. Plus, they can offer critical advice when scaling to the next stage of your business.

Cost Efficiency

When you add up the salary and bonuses, full-time CFOs can be expensive. The advantage of outsourcing is that you get all the benefits of a CFO at a fraction of the cost.

Regulatory Compliance

An outsourced CFO knows how to navigate the complex nature of local, state, and federal regulations, reducing the risk of financial penalties.

Strategic Financial Insight

The role of a CFO is to provide expert insight into finances, helping SaaS companies manage their cash flow, make informed financial decisions, and optimize their profits.

Focus on Core Business Functions

With finances in the capable hands of an outsourced CFO, SaaS leadership can shift their focus on other important aspects of their business, such as product development, customer satisfaction, and more.

Outsourced CFO

Services for SaaS

Financial Strategy

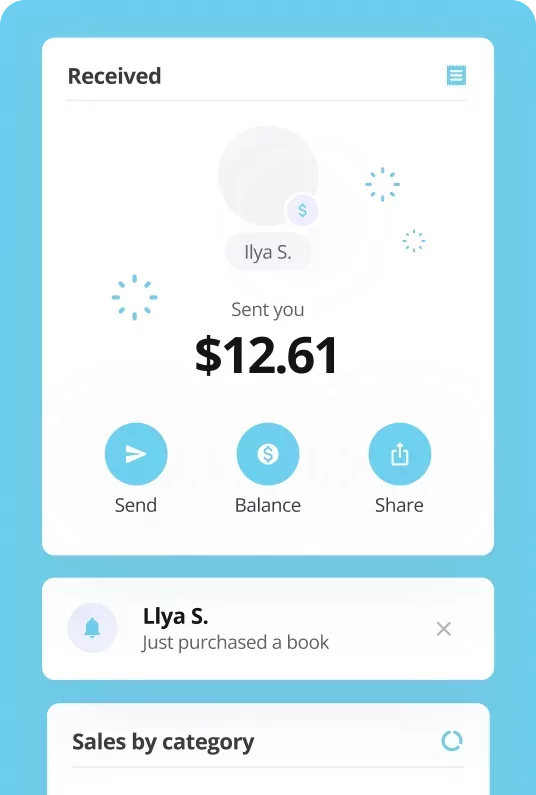

Cash Flow Management

Budgeting and Forecasting

Business Model

Financial Planning and Analysis

Ready to Focus on Your SaaS

Business Growth?

Let Us Handle the Numbers

CFO Services for SaaS

Companies FAQs

What Are Outsourced CFO Services for SaaS?

What Do SaaS CFO Services Include?

SaaS CFO services encompass a broad range of strategic financial functions tailored to the unique needs of SaaS businesses. These services include revenue recognition, which involves accurately accounting for revenue from subscriptions and recurring billing cycles. Additionally, CFOs provide financial planning and analysis, developing detailed financial plans and conducting in-depth analyses to inform business decisions.

Cash flow management is another critical aspect, ensuring your business maintains the necessary cash flow to meet its obligations and invest in growth opportunities. Budgeting and forecasting services assist in setting realistic financial goals and predicting future financial scenarios. SaaS metrics reporting involves monitoring key performance indicators (KPIs) like customer acquisition cost (CAC), customer lifetime value (CLV), and churn rate. Compliance ensures adherence to financial regulations and tax requirements, while financial strategy services focus on creating and implementing strategies aligned with your business objectives to drive long-term growth.

How Does a CFO Benefit SaaS Companies?

Why Choose an Outsourced CFO for Your SaaS Business?

Choosing an outsourced CFO offers several benefits for your SaaS business. Cost efficiency is a major advantage, as it allows access to top-tier financial expertise without the overhead costs of a full-time employee. Scalability is another benefit, as CFO services can scale with your business, providing more resources as your needs grow.

Outsourced CFOs allow you to focus on core business functions, concentrating on customer satisfaction and product development while financial experts handle the numbers. Expertise in SaaS financial management ensures precise and effective financial strategies. Flexibility is also a key benefit, as outsourced CFO services can be engaged as needed, providing flexibility in financial management.