A Chief Financial Officer is a C-level executive responsible for managing all of the financial functions of a company or organization. You might be wondering if it’s time for your business to hire a CFO. In this guide, we’ll dive into what a CFO is, why and when you might need one, and how they can help impact your bottom line as a business.

For a small business to leave a mark in the corporate world, it is imperative that it develops a structure and sustainable financial recordings. This is where a CFO comes in handy. In addition to building a sound foundation for activities in the future, a CFO uses financial expertise and strategic leadership to bring bottom-line success to the company and its stakeholders.

1. What Does a CFO Do?

CFOs, just like other financial positions, perform several essential tasks. Chief Financial Officers are responsible for many duties, including:

Controllership Duties

Controllership duties make the CFO accountable for presenting and reporting accurate and timely historical financial information. A CFO takes care of the company’s complete financials. They’re involved in financial planning and are responsible for tracking the cash flow situation and examining the organization’s financial strengths and weaknesses.

The role of a CFO is not confined to the finance department. Their financial and accounting expertise allows them to make decisions that impact the business. Therefore, they work with all departments to decide how the financial system and operations go hand in hand.

The data that the CFO records is presented to all stakeholders, including shareholders, analysts, creditors, employees, and other members of the top management. Given the sensitivity of the information and the fact that the success of future decisions depends on these numbers, the CFO must take heed to present accurate data.

Treasury Duties

This is where the fundamental difference between a bookkeeper and a CFO lies. A bookkeeper is responsible for recording a business’s financial transactions, whereas the CFO is also liable for the business’s financial health.

The CFO decides how to make investments on behalf of the business while keeping its risk and liquidity in mind. Additionally, the CFO oversees the capital structure of the company, determining the right mix of debt, equity, and internal financing. Looking after issues surrounding the capital structure and ways to generate revenue are some of the most essential duties carried out by a CFO.

Economic Strategy and Forecasting

A company’s past and present status is not the only thing a CFO is responsible for; they play an integral role in shaping and securing a company’s financial future. A CFO should be able to interpret current data while identifying areas where the company is most efficient and the segments where the company needs improvement.

The analysis of the current performance and subsequent forecasting of outcomes involves the use of economic forecasting and modeling. Using the two can help the company predict policies and decisions that will ensure the well-being of a business with regard to the struggling factions it has.

Other Responsibilities

In addition to the above roles, a CFO has to tend to other crucial responsibilities as well. The CFOs are the right hand of business; they advise the business while looking at things from a wider perspective. The broad view and the close attention to financial details help decision-makers form a more comprehensive picture of the current state of the business.

A CFO oversees the process of raising the capital needed to grow the business. From weighing options like equity and debt to the timely collection of revenue, a CFO ensures that a business has the funds for financing its growth.

A CFO must have command over all essential drivers and levers in both the business and the industry that you operate in. Companies today are more data-driven than ever, meaning the CFOs should have the quality to consume all the data.

Being aware of all the vital data means that a business can use the numbers and figures to gain insights needed in a competitive industry.

They strengthen and deepen the relationships with the source of capital, relieving you of the burden of managing relationships with your investors, lenders, critical partners, etc. This allows you to focus on building your business.

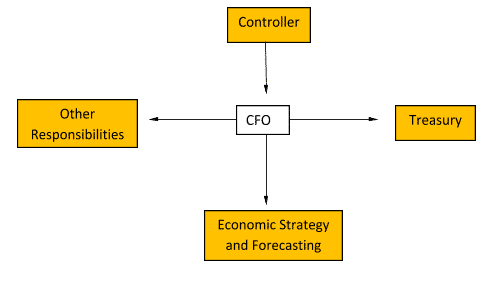

The following key chart will help you understand a CFO’s role better.

2. Why Do You Need One?

You may be wondering: Why do I need a CFO? Many smaller businesses often underestimate the significance of a CFO. These businesses consider the title to be a ceremonious one used by multinational corporations to gain attention.

The truth is that CFOs help scale and track your numbers during times of rapid growth and company expansion. They also help make key financial decisions based on these numbers to accurately guide the organization toward its goals. In the next section, we will dive into when it makes sense to hire a CFO based on the size and needs of your business.

Small and Medium-Sized Business

Taking your business to the next level of growth is a unique challenge. Studying entrepreneurship or discussing it with people currently running businesses will teach you how difficult it is for a small business to succeed.

The chances of having a successful business are so slim that, according to experts, only 10% of businesses survive past the first few years of their launch. Therefore, to ensure your business survives its initial flight and becomes a success story, make the right decisions at the right time.

Although we will discuss the right time for hiring a CFO, the decision to hire one is never wrong, especially if your business is a young one willing to take on the world.

The challenge of taking an SME business to the next level is a challenge that only a well-equipped person or team can take on. Managing the growing turnover, as well as the accounting and finance functions of a business, requires the unique skill set of a CFO.

If you observe that a team member has the potential to make tough decisions and assess financial situations, you should extend the offer to them.

As your operations tend to grow, you will notice that the situation becomes more complex to look after. The services of a CFO will help you take care of other vital issues while ensuring that the business is doing well financially.

The Business Situation

The significance of hiring a CFO stems from a business’s set goals and targets. While it is imperative to stay self-sufficient, a company that does not realize the need for an asset will never be able to adjust to its challenges.

A business that is not achieving its goals and not realizing the reasons for its failure needs to revamp the way it looks at things. A CFO will help decision-makers recognize how a business can achieve its financial goals. Moreover, the CFO will also identify the areas that need improvement to achieve the set goals.

Determining the type of CFO needed and the level of skill they should possess depends on the state your company is in. A fledgling business will require a CFO at times when it is experiencing rapid growth; during this time, a business needs to make dramatic changes to the way it allocates resources.

After tackling the WHY, let us look at the WHEN.

3. When Do You Need a CFO?

A key to determining the need for a CFO is the state in which a business operates and where it expects itself to be in times to come.

The CFO then forecasts and sets future goals for the business while providing leadership in assembling funds necessary for achieving the set goals.

Here are some other scenarios that may prompt a business to hire a CFO:

Developing New Products

With the rapid advancement in technology and changes in trends, current markets are unpredictable. Disruptive technology and shifting market dynamics mean that the new leadership models require change and the ability to adapt.

The CFO can understand and anticipate the need for change, making the position crucial for the business to capitalize on and plan for future growth. A CFO will ensure that the objective to launch a product or to expand doesn’t fall flat by asking all the right questions.

Planning for Taxes

As a business grows its operations, it becomes exposed to further complexities. Taxes are one of them; an increase in the size of a business means that it needs to uphold its tax obligations at a much larger scale now.

Companies facing increasing returns and profits often face complex tax rules and regulations. A CFO helps the business by interpreting and analyzing the changes in the law. Once the difference is accounted for, the CFO provides guidance on improving current tax situations as well as building and preserving assets.

The Need to Understand Margins

If you feel that your inadequate knowledge of business margins is affecting your pricing strategy, then it is high time to hire a CFO. It is quite natural for business owners to be unaware of the cumulative impact thousands of pricing decisions make daily.

This lack of awareness can affect business decisions, resulting in a poorly defined pricing strategy. A poor pricing strategy then results in a significant drop in profits.

During Rapid Expansion

When your company suddenly expands, your company will likely need to implement more automated systems and acquire additional capital and funding. CFOs address fundraising and capital growth. These professionals can interpret data and devise strategies for attaining capital growth.

Without a CFO in position, your company can miss out on critical data analysis, such as market trends that secure the necessary cash flow for expansion. Industries with frequent disruptions and fluctuations or companies with aggressive growth policies benefit most from CFOs. External hires often have valuable experience in M&A due to their external networks and strategic insights.

When Developing New Products

The new product landscape is more unpredictable than ever. Rapidly changing technology, shifting markets, and adapting leadership models require flexible financial solutions. CFOs understand how to pivot financially at the drop of a hat, creating and communicating an effective corporate strategy.

CFOs account for critical issues to ensure businesses can expand without losing vital financial resources. As businesses continue to shift into more globalized markets, CFOs can answer the financial questions that lead to successful growth.

For Mergers and Acquisitions

As businesses prepare for mergers and acquisitions, financial teams must examine the intricacies to ensure a smooth transition. Outsourced accounting firms thrive in these environments. The outsourced accounting firm performs the financial and regulatory legwork so your company can focus on more internal happenings. CFOs should be able to clearly communicate their findings to potential investors and simplify the M&A process.

When Analyzing Profit Underperformance

CFOs can cut costs and analyze pricing strategies to improve their profitability. By unlocking insight into the company’s profit model, they make financial decisions easier from top to bottom. CFOs also keep the CEO, board, and investors aware of past and current financial reports, giving them an accurate conception of the company’s financial strategy.

Increasingly Complex Tax Plans

Tax obligations can significantly hinder a business’s ability to succeed. You may need to hire a CFO if you consistently have difficulties complying with tax regulations as your company grows and increases its net worth.

CFOs can respond to the following tax issues:

- Interpret changes in law and which decisions provide benefits.

- Use the correct tax benefits of investment, capitalization, and M&A opportunities.

- Guide financial overlap between owners, shareholders, and the businesses they own.

- Improve tax positions

- Build and preserve assets.

When you feel the need to make calculated decisions that consider the business’s performance and its set targets, it is high time to call in a CFO. CFOs are in a perfect position to help the CEO establish a financially strong company and create wealth for its owners.

Conclusion – What is a CFO and Why Do I Need One?

A CFO is an executive who helps with all types of financial functions. We covered what a CFO is, when you need one, and why you need one. The benefits are undeniable, as your business will be properly positioned for growth. Regardless of their skill and talent, entrepreneurs have a love-hate relationship with finance. This is where a CFO can help improve your bottom line.

While an entrepreneur may love higher revenue and profits, recording them after the end of each day is a hassle. As time passes and a business increases in size and numbers, the challenge of recording entries becomes almost impossible to champion.

The numerous deals and activities to look after and the burden of making decisions with each passing hour calls for someone who can tend to the financial needs of the business. In the modern world, where entrepreneurship dwells on a competitive landscape, it is imperative to have a solid grasp of numbers.

However, this is a complicated thing to do. Recording transactions and assessing the numbers may be easy when a business is small, but this changes when the business starts to grow.

If you have more questions about CFO functions or are interested in outsourcing your CFO, contact Fully Accountable at 1-877-330-9401.

Chris Giorgio is the President of Fully Accountable. Fully Accountable is an outsourced accounting firm specializing in eCommerce and digital businesses. Chris has served as a CPA, CFO and has over 14 years of experience in the accounting and finance industry. Chris has dedicated his career towards helping entrepreneurs and high-level business owners achieve greater profitability through specialized outsource accounting functions.