CFO Advisory

Services

Gain a CFO with eCommerce expertise for a fraction of the in-house Cost!

A Fractional CFO who is an expert in eCommerce is exactly what you need for your executive team!

Our Customer’s Stories

A CFO will help you make ownership level decisions

The lifeblood of a company is cash. The measure of success is profit margin. Sadly, many business leaders do not know their profit margin or a good margin for the industry the company competes. However, with a reliable accounting team, real-time reporting, and long-term financial planning, your business can unleash its full potential.

Our Fractional CFO’s are equipped to help you make better decisions towards optimal growth, define your margins, maximize cash flow, double profitability, and eliminate the waste of excess tax payments in your company now. We offer comprehensive accounting and financial services, ensuring that no component of your business is neglected and that your books remain completely accurate and up-to-date.

Gain full access to the knowledge and financial expertise of an in-house Chief Financial Officer, without any of the unnecessary overhead costs. Our scalable financial services make it easy for your business to grow, adjust, and pursue new financial opportunities.

End the need for overpaying for generic solutions that aren’t meeting your needs and losing your money. Stop hiring the expensive full-time CFO or in-house solution that will not have the resources to fully maximize results as an expert for your company.

We Aren’t Like Other Virtual CFO Advisory Services, We Offer You More!

Why settle for just business finance solutions when our Fractional CFO Services can be customized and chosen a-la-carte to meet more of your specific needs.

We offer you more of what you need, and less of what you don’t!

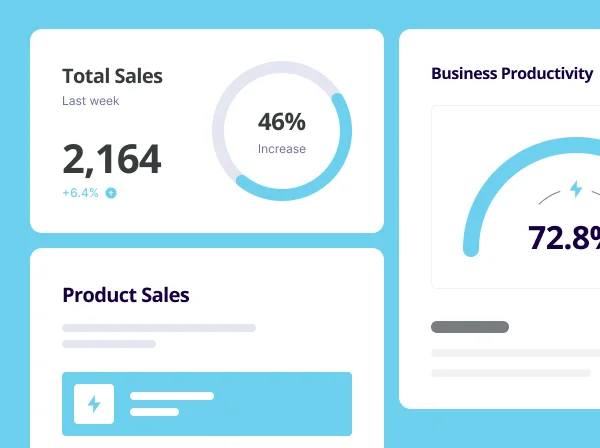

Every business we work with is entirely unique. Your accounting and financial planning services ought to be unique as well. We allow each of our valued clients to choose the services they incorporate and make adjustments over time. For example, your Fractional CFO package can also come with our state-of-the-art proprietary system, Your Back Office. With this, you will receive top-notch outsourced services that incorporate everything your business needs to succeed from KPIs to management reporting seamlessly integrated into Your Back Office.

Your Fully Accountable Fractional CFO Package is customized to give you all of the financial planning services and reporting that you need,and none that you don’t.

We are offering an amazing special right now, you can sign-up for a free call with one of our experts to discuss the needs of your company. Yes, you read that right, for free! Also, as part of signing-up, we would love to send you a copy of our best selling books ‘False Profits’, and “The CEO Mindset’.

We know how to help you because we have been there personally too! Read the story of how our CEO and CFO came together to create the most proactive solutions your business can make through their very own trials and errors in our book, “False Profits”. Accounting and finance are a marathon, not a sprint. Learn how to identify forward-thinking decisions, and how they will help you keep more of your hard earned money.

What Does a

Fractional CFO Do?

Our experienced CFOs utilize financial data compiled by our accounting and finance team to better inform and guide your business with customized bookkeeping solutions, and establish a solid growth strategy. In turn, this will help your company to increase profitability, obtain financing, and attract investors. We utilize our real-world business experience, accounting industry knowledge, and financial expertise to implement strategic solutions that address a full range of challenges and opportunities.

Our experienced CFOs utilize financial data compiled by our accounting and finance team to better inform and guide your business with customized bookkeeping solutions, and establish a solid growth strategy. In turn, this will help your company to increase profitability, obtain financing, and attract investors. We utilize our real-world business experience, accounting industry knowledge, and financial expertise to implement strategic solutions that address a full range of challenges and opportunities.

YOUR CFO EXPERTS & DUTIES

Take control of your finances with an outsourced Chief Financial Officer. Your CFO will be in charge of providing your business with strategic financial insights and guidance.

We will provide recommendations to help your business with:

Cash flow

Analyzing financial reporting

Create strategies based on your finances

With a qualified CFO, you’ll receive financial reporting that forecasts your business’ performance so that you can accurately increase your profits and bottom line. CFOs are responsible for financial decision-making, bookkeeping approval, financial planning, and more. Be knowledgeable of your business’ past, present, and future financial health backed by hard-numbers and reports that pinpoint areas to boost your business’ efficiency and discover room for growth.

Outsourced CFO Services

Financial Analysis and Strategy

Our job as your CFO is to perform regular in-depth reviews of your finances. Your Fractional CFO will always be looking for trends and processes that are inefficient, and opportunities for you to make more informed decisions for your business.

Your Fractional CFO has access to our full team of experts here at Fully Accountable, and together, we will develop a strategic framework to add value and improve the financial performance of your business. Our in-depth competitive industry benchmarking and analysis will evaluate your business’ current performance and sustainability. By providing a strategic financial focus, we are able to gain a competitive edge for your Company in its industry.

- Strategic financial decisions for profitability

- KPI and Benchmark reporting objective metrics

- Managing a budget and forecast

- Cash flow forecasting

- Evaluate business risks and opportunities

- Financial reporting built for your business

Our CFO’s measure your company’s financial performance and provide unbiased feedback with real-time numbers and stats to help your business grow. The financial and accounting solutions your business has been looking for are now readily within reach.

Get Your 7 Advantages a Fractional CFO Can Bring to Your Business Today!

Opportunity and Risk Analysis

We provide an expert analysis of both your current business, and the overall industry. With that information in hand, we can identify risks and opportunities that can affect your business now, and in the future. We’ll then work with you and your team to create a plan of action to navigate around the risks, seizing every opportunity available to you.

Our CFOs identify risks in your business, such as:

- Compliance risk

- Process risk

- Other risks…

- Debt risk

- Personnel risk

- Liquidity risk

- Contract risk

- M&A risk

- Security risk

Without a CFO managing and mitigating your business’ risk and opportunities, you can damage your business’ bottom line and overall reputation. With our team of financial experts at Fully Accountable, you will receive carefully constructed estimates and reports that calculate the probabilities of risk, and an evaluation of how certain risks might have financial consequences.

Cash Flow Projections

We’ll work with you to create financial and cash flow projections that will allow you to determine your current cash flow and what is expected in the future. This type of information gives you insight into when it may be time to:

- Hire additional employees,

- KPI and Benchmark reporting objective metrics

- Purchase additional inventory,

- Invest in new initiatives for your business

As a business owner, you should have confidence knowing that your Company’s financials are on track to hit your business’ growth and performance goals.

Reduce stress and let your CFO provide you peace of mind with careful planning, analysis, and reporting. Cash flow projections enable your business to manage all your cash outflow to ensure your business’s long-term stability. Your CFO will take these projections and make sure that cash is available for payroll, operating costs, and more.

Strategic Financial Planning

We dig deep into the inner workings of your business. Together, with you and your team, we’ll work to identify factors that influence your business’ growth and overall success. Next, we’ll put together detailed financial projections to plan the future of your company strategically.

Our team of qualified CFOs are here to put the most effective financial strategy in place. We are here to ensure that your business can grow based on objective data that will lead to proper decision making. Our service provides:

Systems assessment &

development

Fully Accountable assesses your current business systems to ensure efficiency and accuracy. We’ll also create and implement systems not currently in place to improve overall productivity and profitability.

Things such as your:

- Financial accounting system.

- Accounts payable.

- Purchasing processes.

- Operational Process, and much more.

While your CFO is busy focusing on your finances, you will have the time and knowledge to improve your business’ functions. We will create your business’ strategy with financial modeling and analysis, performance monitoring, business dashboard maintenance, and budget analysis. As time progresses, your CFO can refine your strategy to account for your Company growth and the phase that it is in.

Business Growth

Strengthen your business’ internal controls and overall performance with Fully Accountable’ s CFO business growth solutions. We focus on all areas of your finances so you can focus on your role in your business. Your CFO will provide you with detailed analysis, reports, and keep a pulse on your finances. Rest assured, your business’ CFO is there to show you exactly what is working, and what is not currently working in your business. With our help, you can make good business decisions based on data.

We’ll create an in-depth business growth plan that will allow you the opportunity to strategically project for scale and growth. Using this plan will give you insight into knowing when to:

- Raise capital. Raise capital.

- Add staff members.

- Increase sales and marketing spend.

- Create more revenue streams, or niche down for greater profitability.

Maximize Profitability

We’ll perform an in-depth audit of your entire business operation, looking for inefficient systems, snags and bottlenecks that are costing you profits. Once we’ve identified these pitfalls, we’ll work with you to implement solutions both in the way of new processes and more productive systems.

Your CFO will add value to your business by providing:

- Historic financial statements & results.

- Cash Management.

- Real-time dashboard reporting.

- Entry and exit strategies.

- KPI monitoring.

- KPIs.

- Annual operating budget.

- A budget based on cash flow,

overhead, inventory, and more. - Rolling forecast.

Your CFO is there to help you maximize your business’s profits and performance.

Cutting Costs

Your Fractional CFO is responsible to research and find ways to grow your profit margin and make expense cuts. CFOs suggest new policies and procedures that should be put in place based on an analysis of your cash outflow and your annual revenue trends.

Fully Accountable Fractional CFOs look into:

- Reducing overhead costs.

- Finding more efficient solutions.

- Looking at outsourcing opportunities.

- Looking at creating terms with vendors and additional services.

We will find financial solutions that may have been overlooked by peeling away the many layers of your finances and discover where to cut costs.

Raise Your Capital

It can be both stressful and time-consuming to focus your attention into trying to raise capital. Your Fractional CFO will be there to make the process run smoothly. We will provide all of your financial statements, reports, and documents to determine what financing options will be most appropriate for your business goals.

Outsourcing Your CFO is the Way to Go

The average salary of a Chief Financial Officer is $130,249 annually.

An Outsourced CFO with a high level of experience in finance and accounting will not only save you money, but turn your financial department into a profit center. By outsourcing your CFO, you won’t have to pay a hefty salary of an in-house employee’s expenses which includes health benefits, vacation time, sick days, etc. You want a CFO who is dedicating their time to reviewing and analyzing your company’s performance. Our CFO comes with an entire team that manages the day-to-day of your accounting needs. Just imagine, you can spend your time on your highest and best use, and your CFO can be busy working on growing your bottom line.

Outsourcing is the most cost-effective method of managing your finances.

Why Fully Accountable?

- Financial accounting system.

- Accounts payable.

- Purchasing processes.

- Operational Process, and much more.

Our dedicated team of US-based CFOs at Fully Accountable are experts in accounting and financing. Your business deserves to grow and with a thorough financial analysis, industry benchmarking, and setting objective KPI metrics for performance, you can objectively scale your business profitably. With Fully Accountable’s proprietary system, ‘Your Back Office’, your business will receive top-notch outsourced services that incorporate everything your business needs to succeed, from KPIs to management reporting.

Fully Accountable is with you every step of the way.